Leaders in Finance Future of Wealth Event 2024

SPEAKERS

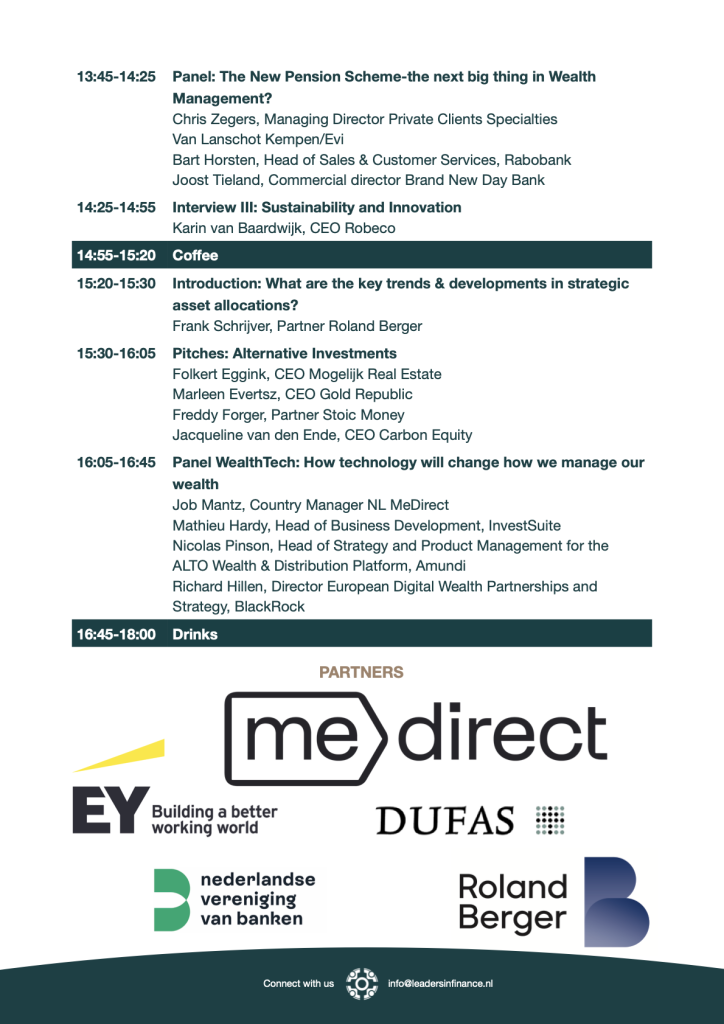

PROGRAM

PARTNERS

PRE-EVENT INTERVIEWS

In the run-up to this event we interview speakers, panelists and other thought leaders on Wealth Management. What are the biggest challenges and what are the biggest opportunities? What shifts do they notice in the market? What is their opinion on ESG policies, consolidation in the market, the role of the personal advisor and the role of tech? What’s their role in the space and what is the role they want to play in the future.

*** Job Mantz, Country Manager MeDirect Netherlands ***

“From my perspective, wealth management extends beyond the realm of specific products. While many might define it as someone overseeing and managing your wealth, typically through asset or portfolio management solutions (known as “vermogensbeheer” in Dutch), I believe we should broaden this definition. It is fundamentally about managing someone’s wealth, and this does not necessarily tie to a specific product. The broader question is: how do we manage wealth? Whether it is through execution only, discretionary portfolio management (DPM), or advisory services – essentially, it’s about finding the approach that aligns with the customer’s preferences.”

Read the full interview here: https://www.leadersinfinance.nl/pre-event-interview-job-mantz/

“There are numerous challenges, but there are also many opportunities to consider. One of the significant opportunities lies in the adoption of technology, AI, and related areas to enhance the delivery of value to clients. This isn’t solely about simplification but rather a concentrated effort on delivering substantial value to clients. Partly driven by the same is scaling the actual wealth management and service proposition around financial advice. And the last point that I want to call out here is the expansion of the holistic view on wealth management by placing a broader emphasis on market developments, such as the increasing prominence of the pension transition when it comes to wealth management in general.”

Read the full interview here: https://www.leadersinfinance.nl/pre-event-interview-boudewijn-chalmers-hoynck-van-papendrecht/

*** Frank Schrijver, Partner Financial Services Roland Berger ***

“I find it interesting and valuable to consider multiple perspectives on wealth management. One could focus on the products the clients could or should acquire, or on the interaction methods, such as digital purse and hybrid advisory. An equally intriguing aspect is how clients manage their asset allocation. Reflecting on what is logical and should be logical over time in terms of optimizing wealth—balancing investments in securities, fixed income, and alternative assets—offers opportunities for simplification and streamlining.”

Read the full interview here: https://www.leadersinfinance.nl/pre-event-interview-frank-schrijver/

*** Bernt Kok, CEO Wealth Management NL BNP Paribas ***

“When it comes to challenges, I see these as opportunities for BNP Paribas Wealth Management. With our international footprint and with the scale of more than EUR 415 billion assets under management we are ideally positioned to meet our clients’ expectations to bring tailormade solutions for the growth and preservation of their wealth as well as the investment strategy. Our clients are internationally well connected and very well-informed, making it progressively interesting to fulfil their expectations with international solutions and offerings. With our scale we have the ability to invest in the challenge keeping up with technology.”

Read the full interview here: https://www.leadersinfinance.nl/pre-event-interview-bernt-kok/

*** Sybelle Gielisse, Head of Wealth Management Rabobank ***

“Currently, there are a couple of intriguing aspects we’re focusing on at Rabobank. Firstly, there’s a significant emphasis on adopting a “naturally green” approach in our investment portfolio. Despite regulatory constraints, we’ve committed to a single, distinct category—Article 8, which we refer to as “naturally green.” This stands out from the common distinction between green and brown or light and dark green. We prioritize performance while maintaining a natural, sustainable environment, aligning with our values. In contrast to other major banks in the Netherlands offering two investment options (sustainable and non-sustainable), we’ve opted for a unified sustainable approach within Article 8, ensuring both returns and environmental consciousness. That’s one key focus area for us.”

Read the full interview here: https://www.leadersinfinance.nl/pre-event-interview-sybelle-gielisse/

*** Joost Tieland, Commercial director Brand New Day Bank ***

“There is substantial work to be done in the Netherlands before January 1, 2028, when all pension funds are obligated to transition to the WTP schemes. While this presents a great opportunity, it’s crucial for us as a sector, including Brand New Day and other market players, to collaborate and grab this chance. If we fail to do so and don’t generate enough traction in the market, the government may intervene. The government sees it as their responsibility to ensure everyone has sufficient income when they reach their pension age. We should’t miss the opportunity and risk the government imposing measures, such as obliging individuals to build up pension wealth in a state fund, as seen in countries like Norway and Sweden. If we don’t act, the market may become significantly smaller, and it’s within our span of control to prevent that from happening.”

Read the full interview here: https://www.leadersinfinance.nl/pre-event-interview-joost-tieland

AUDIENCE

This Leaders in Finance Event is about Wealth Management. The event should be of great interest to leaders working directly in Wealth Management, Private Banking, Asset Management and Product Managers, but also to leaders for whom Wealth Management is not daily business, but are interested in the subject and the growth of the market. Officers are: managing directors, directors, managers and team-leads.

With this event we have a clear mission and focus on achievements!

- First, we want to bring the -financial- professionals in the Wealth Management and Private Banking space together and encourage knowledge sharing and exchange of best practices.

- Secondly, we hope to add value in the deepening of cooperation between the different stakeholders in the Wealth Management sector, among other things, by facilitating the forming of new relationships and to deepen existing relationships.

- Finally, above all we want to achieve that all participants will travel home after the conference full of energy and enthusiasm.